Annual tax filing for YA 2009 – are we ready

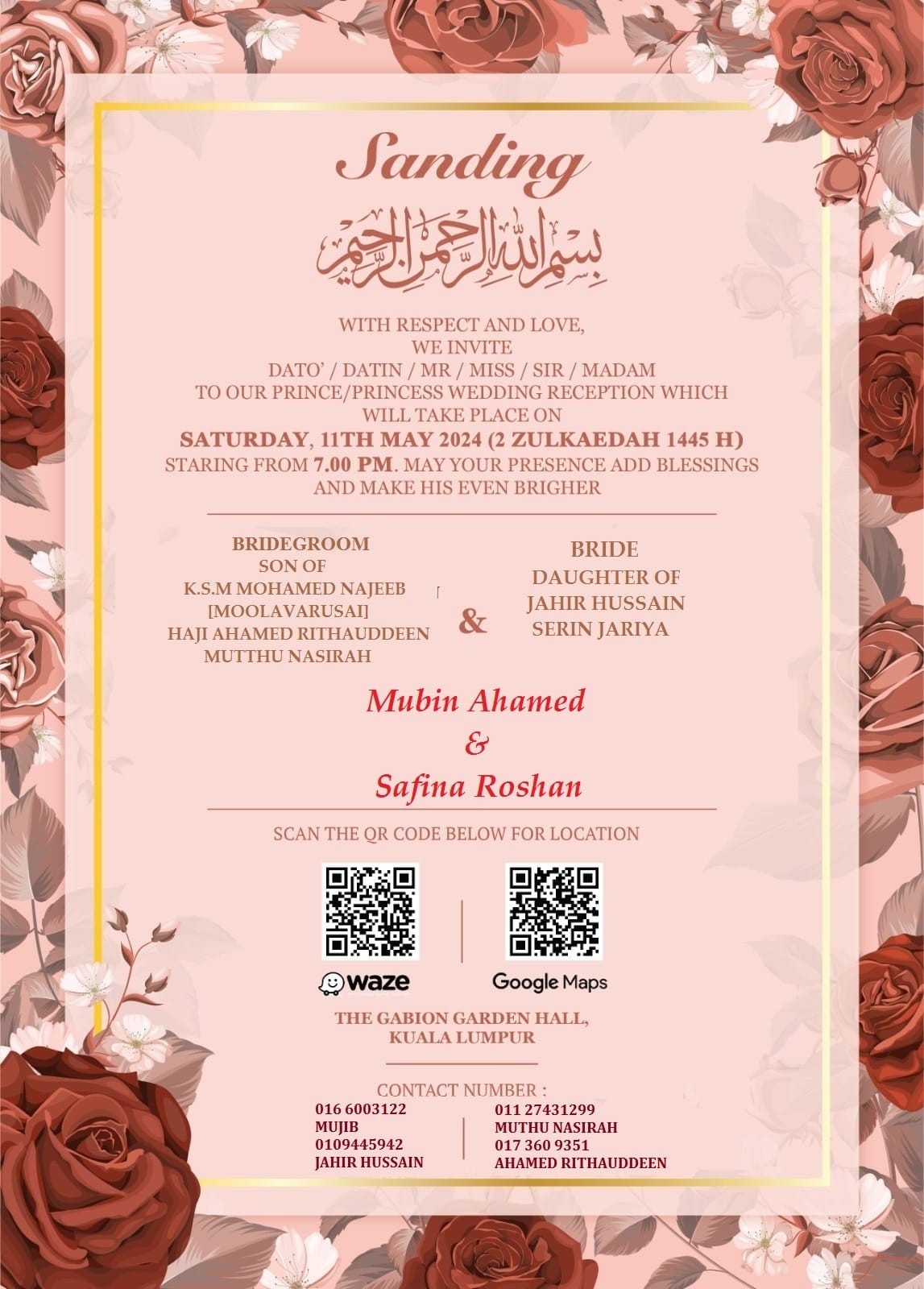

- WEDDINGS & EVENTS

- Annual tax filing for YA 2009 – are we ready

Annual tax filing for YA 2009 – are we ready

With one week left to complete the current year, we can still tax plan for the next annual tax return for assessment year 2009. The annual tax filing due date for individual with employment income is 30 April 2010. Individual with business income is on 30 June 2010.

Here are some of the reliefs and rebate that you can check to minimise the tax liability. Do consult and work with your tax agent to ensure your claim is in order. And remember to keep the receipts and supporting documents as the Inland Revenue Board will require them for inspection.

1. Education relief

Fees for acquiring technical, vocational, industrial, scientific, technological, law, accounting, Islamic financing, skills or qualification at tertiary level or any course of studies at post graduate level – max RM5,000

2. Medical expenses

a) Medical expenses for self, wife and children on serious diseases – maximum claim RM5,000 (also include medical examination expenses of RM500).

b) Parent medical expenses – max RM5,000.

3. Purchase of books, magazines and other similar publications for self, wife or children- max RM1,000.

4. Purchase of computer – a maximum of RM3,000 is given once in three years. If separate assessment is elected, spouse will be eligible for a separate claim.

5. Saving for children in Skim Simpanan Pendidikan Nasional (SSPN) – max RM3,000.

6. Purchase of sport equipment – RM300 (attire and shoes not included).

7. Interest paid on housing loan – Relief of up to RM10,000 is given for 3 consecutive years from the first year the housing loan interest is paid. Subject to following conditions:-

a) Malaysian citizen and resident;

b) Limited to one house including flat, apartment or condominium;

c) The sale and purchase agreement is executed between 10 March 2009 and 31 December 2010.

8. Spouse and children relief

a) Spouse relief

If a husband/wife has no source of income or elects for combined assessment, a relief of RM3,000 is given to the spouse.

b) Child relief

a) Relief can be claimed by husband or wife.

b) Child below 18 years – RM1,000

c) Child above 18 years – overseas and local universities, colleges and similar establishments – RM4,000

d) Disabled child (unmarried) – RM5,000

e) Disabled child pursuing tertiary education – RM4,000

9. Relief for EPF (or other approved fund contributions) and life insurance premiums savings – max RM6,000.

10. Insurance premiums for medical and educations – RM3,000 max

11. Disabled relief

a) Disabled person will be given a further deduction of RM5,000.

b) Purchase of supporting equipment for disabled will qualify for RM5,000 relief (parent, wife and children included).

12. Rebate for zakat

Settle the zakat dues by 31 December and you can claim rebate from taxes due. On top of that you can cleanse and purify your wealth. It is best investment of all investments.

Selamat Mencuba,

Salam,

Faisal

Categories

Events

Blog Archieve

- [+] 2025 (1)

- [+] 2024 (2)

- [+] 2023 (2)

- [+] 2021 (2)

- [+] 2020 (8)

- [+] 2019 (5)

- [+] 2018 (5)

- [+] 2017 (4)

- [+] 2016 (16)

- [+] 2015 (42)

- [+] 2014 (36)

- [+] 2013 (15)

- [+] 2012 (19)

-

[+]

2011 (61)

- [+] January (7)

- [+] February (7)

- [+] March (4)

- [+] April (1)

- [+] May (5)

- [+] June (1)

- [+]

July

(8)

- Kem Ibadah Wanita Pra-Ramadhan

- Invitation to Majlis Berbuka Puasa MAMJ

- Majlis Berbuka Puasa MAMJ 2011

- Ramadhan 2011 Fund

- Another Achievement by Our Past President Haji Mohamed Ismail Sharif – He is Among the Top 50 Islamic Finance Lawyers Globally. Alhamdulillah

- பட்டமளிப்பு விழா

- Majlis Buka Puasa Amal 2011 – Anjuran Indiamuslim.org (IM.ORG) Dengan Usahasama Muslim Manaver Sanggam (MMS)

- Chess tournament

- [+]

August

(9)

- ALL RELIGIONS SAY ‘ONE’ – Part 2 (In Hinduism, Sikhism, Christianity, Judaism, Confucianism & Buddhism)

- ALL RELIGIONS SAY ‘ONE’ – Introduction

- PENYERTAAN PAS DALAM PERARAKAN BERSIH 2.0

- BAN ON RECITAL OF THE QURAN OVER LOUDSPEAKERS IN PENANG

- MY VIEW ON MARISA DEMORI’S LETTER IN NEW STRAITS TIMES

- THE ISSUE OF MURTAD (APOSTASY)

- ALAGAI PATTAMALIPPU VIZHA

- THANK YOU MAMJ MEMBERS

- RAMADHAN MUBARAKH!!!!!

- [+] September (5)

- [+] Octobar (4)

- [+] November (3)

- [+] December (7)

-

[+]

2010 (160)

- [+] January (8)

- [+] February (3)

- [+] March (1)

- [+] April (3)

- [+] June (1)

- [+]

July

(15)

- ஜோதிடம் , சகுனம் பார்த்தல் : இஸ்லாமியக் கண்ணோட்டம்

- OUR PRESIDENT AND DATIN VISIT DR.APJ ABDUL KALAM

- உம்மத்தின் வழிமுறை

- IBUBAPA

- The Key to Raising Righteous and Successful Children

- ங்கள், செலவழிக்கும் முன் சம்பாதியுங்கள்

- A New Domain Extension “.CO” Launched

- தாம்பத்திய உறவு

- கமலாதாஸ் – ஸுரையா :

- உறவுக்கு அப்பால் தாய் தந்தை

- PERIYAR DASAN’S SPEECH AT JEDDAH:PHOTOS

- பெண்ணுரிமையும்! இன்றைய பெண்களும்!!

- FAMILY VALUES : THE MOTHER

- Invitation to Program Rapat 1Malaysia

- Just See What British Thought of India and How They Managed to Rule Us

- [+]

August

(19)

- ALLAH THE GREATEST

- RAMADHAN : MONTH OF PATIENCE

- My Mother, My Best Friend

- RAMADHAN : MONTH OF PATIENCE

- Enriching the Community

- ZAKAT DISTRIBUTION

- 6-Story Jesus Statue Struck By Lightning!!!

- இல்லறமே நல்லறம்!!!

- வரதட்சணை : பூனைக்கு மணி கட்டுவது யார்?

- Dato’ Haji Thasleem and Datin Dr.Yazmeen with Dr. APJ Abdul Kalam

- அமைதியை இழந்து தவிக்கும் அமெரிக்க வீரர்கள்!

- WE ARE THE HONORABLE WOMEN OF ISLAM!

- Recent Archaeological find by Aramco During Gas Exploration in Saudi Arabia- Subhanallah

- ஒரு சகோதரியின் உலக சாதனை !

- BELOVED AMMA & ATTHA

- எதை கொடுப்பது ? எதை எடுப்பது?

- திருமணம் என்பது ஒவ்வொரு மனிதனில் வாழ்விலும் ஒரு முக்கியமான அம்சம்.

- முஸ்லிம்களுக்கு ஏன் இவ்வளவு பெருமை என்று வியந்தேன்…

- ஏன் இஸ்லாம் — ஆமினா அசில்மி

- [+]

September

(21)

- A Police Officer Wrote This! Please Read coz may Save your Life!

- Al-Quran

- APPEAL FOR LAND BY MAMJ

- History Mystery – Interesting and Incredible

- Makkah (SubahanAllah) -Current Development

- Prophet Muhammad SAW Praised by Non-Muslim Leaders and Philosophers

- Interactive Sites on Medical Information

- Indraiya Poluthu Iniya Poluthaaga Amaiyattum

- BABRI MASJID CASE -JUDGEMENT ON 24TH.SEPTEMBER 2010

- நபி மொழிகள் !!!

- The Minor Signs of the Last Day

- அல்லாஹ்விடம் உதவி தேடுங்கள்!

- Walking Helps Keep Body and Brain Young

- NY imam says mosque fight worth the controversy

- BELOVED ATTHA : YOU ARE THE BEST

- ஒரு குத்துச்சண்டை வீரரின் அழுகை!

- Ahmedabad’s Bus System a Hit with Several Countries

- Breaking News-RAMADHAN FUND 1431H

- All for a Palm Tree in Jannah

- MAMJ President at The Orphanage in Kg.Manjoi Ipoh

- MAMJ President at Buka Puasa Organised by Tanjung Muslim Association Penang in Association with Penang Hindu Sangam and Klinik Derma Sivasanta

- [+]

Octobar

(34)

- The Human Camera

- Outstanding Animations

- Best Signpost in India

- காய்கறிகள் பழங்கள் மூலமாக இருதய அடைப்பை நீக்க முடியுமா ?

- Better to be Lion Hearted!

- Peace of Mind Tips and Advice

- சில பொன்மொழிகள்..

- India’s Rare Pictures

- Home of a Mexican Drug Lord being raided!

- What is I C E ?

- Life iN the Year 3000

- GEMS OF WISDOM

- Regular Health Mistakes

- மகிழ்ச்சியாக இருப்பதற்குக் காரணங்கள் தேவை இல்லை

- Existence of Allah

- TO ALL AMMA’S : IMPORTANCE OF BREASTFEEDING

- ஆரோக்கியமாக வாழ ..

- Brain Damaging Food and Habits

- The status of the family in Islam

- Allah looks to your Heart & Deeds

- Shine a Light and enjoy your Coffee

- Be Very Careful of Rat Urine/Droppings

- THE PAST IS GONE FOREVER!!!!

- Taxi in Dubai

- Coincidental! – Good for Your Health

- ALLAHU AKHBAR!!

- The First Medical Council in The World

- Inside Ka’bah & Airmata Rasulullah SAW

- A Muslim Student in India Fights for Her Right to Dress in Islamic Way

- The Best Person in The History of Mankind

- FABULOUS COMPILATION

- ETIQUETTE OF NAMING CHILDREN

- Islam Again in Ayodya

- Interview with British Journalist Yvonne Ridley

- [+]

November

(38)

- Suhas Gopinath from Bangaluru,WORLD’S YOUNGEST CEO

- IF YOU HAVE A WILL, YOU WILL!!!!

- DISIPLIN ANAK-ANAK!!

- BE READY!!!!!!!!!!!!!

- REMEMBER! REMEMBER! REMEMBER!

- 360 DEGREE PICTURE – THE COCKPIT OF THE AIRBUS A380

- Allah takes Your Soul When You sleep

- 16 Amazing Photos that captured the world

- Be Amazed By The Beauty Of Nature

- MAMJ Presidents Speech at Masjid Muslim India Ipoh

- A Story of Appreciation

- Mirror or 2-Way Glass? BE CAREFUL

- God’s Work

- English is a Funny Language

- Hari Raya Aidiladha Wishes

- Superb Sentences By Famous People

- Dont Be Serious, Be Sincere

- Eating Fruits The Proper Way

- MUSLIM MOROCCANS LIVEHOOD

- Tony Blair’s sister-in-law Lauren Booth converts to Islam

- Success dosen’t come within a day! – MAMJ n Alagai Makkal

- பெண்

- THE SMALLEST GIRL IN THE WORLD!!!!!

- கோபம் – வேண்டவே வேண்டாம் !!!

- FED UP OF LIFE?

- SOCIAL CLASSES IN ISLAM???

- The Charles Schulz Philosophy

- ஆசைகளை சீர்படுத்துங்கள்

- ஆசைகளை முறைப்படுத்துங்கள்

- CWG 2010 Special – PHOTOGRAPHY

- Sejda Miracle

- Wedding Dates -Avoid Clash of Dates

- New Drug in Schools? Parents Please Take Note

- DEATH SENTENCE FOR A KIDNAPPER IN YEMEN

- AMAZING TRAIN ROUTES

- RICH INDIA? POOR INDIA? DO YOU BELEIVE THIS?

- One Call (ESTAWOO = Arrange yourselves) and The Impossible Happens

- To All Parents!

- [+]

December

(17)

- 14 YEARS OLD MOHAMED SUHAIL’S ACHIEVEMENTS:

- CONGRATULATIONS TO ALL MAMJ STUDENTS WHO SUCCEEDED IN PMR

- Notification of Wedding Dates

- Benefits of Drumstick leaves ( Tamil – Murungai leaves )

- Small teaser for Alagai Makkal..Enjoy!

- Niagara Falls 99 years ago. Worth Looking At

- 4 THINGS YOU PROBABLY NEVER KNEW YOUR MOBILE PHONE COULD DO

- ALAGANKULAM BIRDS SANCTUARY

- The Goodthings of HONEY

- The Ugly Briton

- The Cucumber

- Naive, Dim-wit or Extreme?

- Worth reading!

- Unconditional Love

- Muharram Message

- Muharram Greetings

- Amazing Houses Around the World – General Knowledge for Alagai Makkal

-

[+]

2009 (20)

- [+] September (2)

- [+] Octobar (3)

- [+] November (4)

- [+]

December

(11)

- Islam and Science

- Speak more in Malay -Dr. M Tells Indian Muslim

- Annual tax filing for YA 2009 – are we ready

- Divorce?! Separated!? Why?

- Wearing hijab – Compulsion, option or willingness?

- MAMJ EXCO MEET THE MEMBERS AT SUNGAI PETANI

- DINNER AND GIFT PRESENTATION TO EXCO MEMBERS 2006 – 2009

- Newspaper Clippings from India

- Eid al-Adha and Hajj 2009

- Thoughts to Share

- 2009 MAMJ Imam Al-Ghazzali Merit Awardees

- [+] 1996 (1)

- [+] 1993 (1)

- [+] 1881 (1)

-

[+]

0 (1)

Advertisement

Newsletter Sign Up

For Latest Updates